Library Referendum FAQ

- Why is the library submitting a proposition to the voters now?

- What critical infrastructure issues require immediate attention?

- Are the infrastructure issues a result of neglect?

- What steps did the Library Board take to come to this decision?

- When was the last time the library asked for a tax increase?

- Tell me more about the expiring building bond.

- What happens if the Referendum passes?

- What happens if the Referendum fails?

- What will the April 1, 2025 Consolidated Election ballot say?

- What is the Supplemental Information that will be listed on the Ballot?

- Can you explain #2 under the Supplemental Ballot Information?

- What would this referendum mean to me?

- What am I currently paying for library service?

- Why aren’t you asking for another bond instead of an operations increase?

- How is the CAPLD funded?

- Where do my taxes go if I live in Chatham?

- How big is the CAPLD? (who is served by the district)

- What do the Friends of the Library do?

- What does the Foundation do? Explain the Backyard project.

- Who can I call for more information, or how can I take a tour?

Library History and Statement

The Chatham Area Public Library District’s (CAPLD) current building was built in 1995 and expanded in 2009. As is common for any heavily used public structure, the 30-year-old building and its systems are aging and need extensive repair and updating. The building is experiencing structural issues despite adhering to a thorough maintenance routine. The Library Board had a building leak investigation completed in 2022 by Graham & Hyde, a Springfield architecture firm, and O’Shea Builders, a Springfield commercial construction services firm. The report indicated that significant infrastructure issues on the North and East sides of the building are allowing water to infiltrate the building. Also, in 2023, the Library Board had a facility assessment conducted that showed several systems are nearing their end of life and need to be repaired or replaced.

CAPLD’s mission is to provide excellent services in a welcoming, safe environment. To continue to serve the community in the safest, most efficient, and most effective manner, the Library Board determined the need to address these issues. The Library Board is seeking to address current water leaks. These leaks threaten the safety of our building. At the same time, the Library Board seeks to continue a program of long-term maintenance and management while also assuring library staff have the necessary resources to provide excellent services to the entire community. The funds available to the library are limited, which caused the Library Board to seek short- and long-term financial projections, which were completed by James Rachlin, a financial advisor with Meristem Advisors, in 2023. Based on Mr. Rachiln’s findings, additional income is required to address building repairs, ongoing maintenance, future planning, and added services.

The Chatham Area Public Library District is governed by a board of seven Library Trustees, who are elected by district residents. Each Trustee serves for four years, and the Library Board is responsible for setting Library Policy, approving the budget, and evaluating the Library Director.

1. Why is the library submitting a proposition to the voters now?

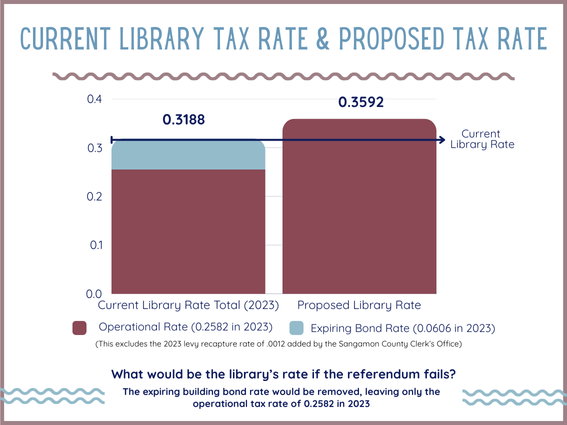

The bonds approved by voters in 2007 will be fully paid off by February 2026, meaning the library will stop collecting taxes for that fund. To provide the resources for handling imminent building repairs and ongoing maintenance, purchasing materials, funding programs and events, and compensating staff, the Library Board of Trustees is submitting to the district’s voters an increase to the operating tax rate. In essence, the proposition on the April 2025 ballot will ask voters to reallocate the tax rate from the expiring bond to the operational fund with a minimal annual increase, as shown in the chart below.

2. What critical infrastructure issues require immediate attention?

The main issues are on the North and East sides of our building. Based on the architectural firm Graham & Hyde and O’Shea Builders assessment, the cost to address the Library’s issues would be around $750,000.

- Non-draining Exterior Insulation and Finish System, or EFIS, on the arch, causing water to enter the building from the north side. EFIS is an exterior wall cladding system consisting of field-applied rigid foam insulation panels outside a building's wall framing and sheathing, coated with a relatively thin layer of synthetic stucco.

- Non-draining EFIS surrounds the 60 large windows on the east side of the building, near the top of the roof.

- The rubber roof on the eastern side of the building, which holds the majority of the building’s HVAC units, needs replacing. The cement pavers holding the HVAC units are disintegrating into the rubber roof, causing cracks and holes.

- The planters on the east side of the building are not properly draining out of the building.

For a more detailed list of our building's critical infrastructure issues, please refer to the third-party report conducted by Springfield architect firm Graham & Hyde.

3. Are the infrastructure issues a result of neglect?

No. The infrastructure issues are not the result of a lack of building maintenance. These infrastructure issues were inherited when our building maintenance plan failed to resolve the root cause of the water leaks. The report provided by architects Graham & Hyde and O’Shea Builders in 2023 concluded that:

Overall, we found the facility is in excellent condition and provides the appropriate access and services required of a library. In addition to the typical aging and weathering of materials (i.e., flooring, paint, sealants, roofing, brick, windows, paving, etc.), your staff has taken excellent care.

And:

From our observations, the library is a well-utilized facility operated by a staff who takes great pride in its appearance and functionality. As with any building, there comes a time when upgrades and maintenance inevitably will extend beyond the annual allowable budget where additional funding is necessary. Planning ahead and including budgeting to accommodate these expenditures is the most proactive method to ensuring the longevity of the facility. Based on our assessment work, the library can save several hundred thousand dollars through proper planning and proactive maintenance.

4. What steps did the Library Board take to come to this decision?

The Library Board has worked to address the water issues in the library building for many years. In 2022, the Library Board enlisted the assistance of Graham & Hyde, a Springfield Architectural firm, and O’Shea Builders, a Springfield commercial construction services firm, to conduct a leak investigation.

Then, in 2023, the Library Board invited both companies to conduct a facilities assessment of the entire building. This investigation showed that while the library building has been properly maintained, normal wear and tear of expensive items, such as the metal roof, parking lot, and 12 HVAC systems, would need to be addressed in a timely manner to ensure the library building remains in good condition.

Based on the assessments conducted by Graham & Hyde and O’Shea Builders, the Library Board sought to understand the long-term financial implications of the immediate and future repairs and maintenance required for the building. James Rachlin, President of Meristem Advisors and a financial advisor to the Library Board, presented both short-term and long-term financial projections. These projections revealed that without action, the Library would face a financial shortfall, making it challenging to sustain necessary repairs and ensure long-term financial stability. Mr. Rachlin recommended transferring the tax rate from the expiring building bond to the operational fund with a modest increase. This adjustment would address immediate and future maintenance needs, ensure financial stability, maintain a reserve, and eliminate the need for a referendum to secure additional funding for many years, all while supporting the Library's services.

At its special meeting on December 10, 2024, the Library Board voted to proceed with a referendum, asking the voters to decide whether to increase the limiting rate.

5. When was the last time the library asked for a tax increase?

The CAPLD voters passed an operational tax increase referendum in 2003. Before that, the library’s tax rate was $0.15 cents, which was increased to $0.25.

In 2007, the district's voters passed a 20-year building bond referendum that allowed the library to expand to its current size of more than 29,000 square feet. These bonds are similar to how a home mortgage works. These bonds are paid for by levying a construction bond tax rate. The bonds will be paid off in full as of February 2026 (one year early due to the Library Board’s refinancing of the bond in 2016, saving the taxpayer one year or $350,000 of payment for the building expansion), so the library will no longer be collecting for the building bond tax.

6. Tell me more about the expiring building bond.

On property tax bills that support the CAPLD, provided by the Sangamon County Clerk’s Office, the 2007/2016 bond is listed as CH LIB BD2 (the first bond for the library was in 1994, and built the original library building on Spruce Street.)

In 2007, the CAPLD voters agreed to fund the library building expansion, which was thus paid for by levying a 20-year construction bond tax rate. Building bonds are similar to a home mortgage. In 2016, the Library Board refinanced the interest rate from 4.2% to 1.75% on the bond payments, thus saving the CAPLD taxpayers one year of paying on the bond and more than $350,000 collectively.

The library will pay its last payment on the building expansion in 2026, 19 years after the bond referendum was approved. The library building will then be completely paid off, and there will be no outstanding debts.

Replacing the expiring construction bond with a slightly increased operational tax presents an opportunity for the library to attend to significant building infrastructure maintenance issues and maintain or enhance services while reducing the impact on the taxpayer.

7. What happens if the referendum passes?

- Required Building Projects Advance: The needed repairs to the building will be immediately addressed.

- Long-Term Fiscal Sustainability: The Library will plan for capital maintenance for our 30-year-old building, including HVAC repairs, carpet replacement, more private and collaborative study/workspaces, energy-efficient components, parking lot maintenance, wall repairs and painting, window and door replacements, and furniture updates, to name a few. It will also remove the need for the library to ask for additional tax rate increases for the foreseeable future.

- Enhanced Materials, Services, & Spaces: Once the required repairs and ongoing maintenance issues are addressed, the Library can focus on reducing print and digital wait times and developing a variety of flexible spaces and services to meet the needs of our growing community.

8. What happens if the referendum fails?

Regardless of whether the referendum passes or fails, the Library must address the immediate water infiltration issues that are occurring on the North and East sides of the building. If the referendum fails, the Library would need to utilize current operating and reserve funds to address the required building repairs, which would likely divert some of those funds from other priorities, such as:

- Reduced Services and Hours: There may be a noticeable decrease in in-house and external classes and programs. Outreach and off-site programming to local organizations and senior living facilities will be affected and possibly discontinued. In the future, hours may need to be reduced to provide funds for maintenance needed to keep the building operating.

- Limited Materials and Access to Technology: The selection of materials may be limited, and wait times for new books, movies, music, and downloadable content will be longer. Technology access and services may be reduced, limiting resources available to patrons, such as public computers, free technology classes, and limited funds to purchase updated equipment.

- Minimized Building Maintenance: Only basic repairs will likely be completed. While it is projected that over two million dollars over the next ten years are needed for capital improvements, such as repairing the water infiltration issues on the North and East sides of the building, commercial heating and air conditioning system, a new roof, and other normal wear and tear issues of a public building of our size, repairs, and maintenance will likely only be addressed on an as-needed basis.

9. What will the April 1, 2025 Consolidated Election ballot say?

Shall the limiting rate under the Property Tax Extension Limitation Law for the Chatham Area Public Library District of Sangamon County, Illinois, be increased by an additional amount equal to 0.095600% above the limiting rate for the purpose of the establishment, maintenance, and support of the public library for levy year 2023 and be equal to 0.359214% of the equalized assessed value of the taxable property therein for levy year 2025?

10. What is the Supplemental Information that will be listed on the Ballot?

The following supplemental information shall be included on the ballot in compliance with Section 18-190(a) of the Property Tax Extension Limitation Law, 35 ILCS 200/18-190(a):

SUPPLEMENTAL BALLOT INFORMATION REQUIRED BY 35 ILCS 200/18-190

(1) The approximate amount of taxes extendable at the most recently extended limiting rate is $1,278,690.00 and the approximate amount of taxes extendable if the proposition is approved is $1,778,945.00.

(2) For the 2025 levy year the approximate amount of the additional tax extendable against property containing a single family residence and having a fair market value at the time of the referendum of $100,000.00 is estimated to be $33.67.

(3) If the proposition is approved, the aggregate extension for 2025 will be determined by the limiting rate set forth in the proposition, rather than the otherwise applicable limiting rate calculated under the provisions of the Property Tax Extension Limitation Law (commonly known as the Property Tax Cap Law).

11. Can you explain #2 under the Supplemental Ballot Information, including why you show comparisons on a $100,000 home?

For the 2025 levy year, the approximate amount of the additional tax extendable against property containing a single-family residence and having a fair market value at the time of the referendum of $100,000 is estimated to be $33.67.

The $100,000 fair market value is taken directly out of the referendum question on the ballot. The District has no choice in how the question is presented, as the wording and calculations are specified by Illinois State Statute.

The current library bond will expire in 2026, and the library will stop collecting taxes for that fund. In order for the Library to capture the funds currently being used for the Library bond for operations, the Supplemental Ballot Information above shows what a single-family residence with a fair market value of $100,000 would pay for the library's operations rate.

A home with a fair market value $100,000 is currently paying a total of $106.67 ($86.45 for operations and $20.20 for the building bond).

If the referendum passes, this property owner a total of $119.74 (an additional $13.07).

The after-referendum amount of $33.67 stated in the ballot question represents the building bond rate ($20.20) + additional rate ($13.47), which is slightly different because of the required calculations.

12. What would this referendum mean to me?

If this ballot measure is approved, a median Chatham home valued at $285,000 will pay approximately $38.39 more annually above what is currently being paid.

Listed below are other home values, which is an approximately $13.47 per $100,000 house valuation:

Based on operational tax rate and expiring building bond tax rate added together

Added cost of the additional tax rate (.0404) beyond the operational rate (.2582) and reallocated expiring building bond (.0606)

Most up-to-date information as of Tax Levy Year 2023.

To determine the amount for your home, you can use this calculator.

13. What am I currently paying for library service?

The Sangamon County Clerk’s Office website can be accessed to show how much CAPLD residents pay for library services annually. You can view your tax bill details by visiting the County Clerk’s website: https://tax.sangamonil.gov/SangamonCountyWeb/app/searchByParcelNumber.action

Example:

A property in Chatham has an assessed value of $285,000. The property owner is paying $245.29 for the library's operations and $57.57 for the 2016 Bond, for a total of $302.86 for the tax year 2023.

If the referendum passes, the property owner will pay an estimated additional $38.39 annually, for a total of $341.25 (28.44 per month).

14. Why aren’t you asking for another bond instead of an operations increase?

An operating tax increase is a set rate change, whereas bonds are for a finite amount of time, and they require taxpayers to pay interest during repayment, similar to a home mortgage. Facility assessments and planning studies conducted by professional third-party companies (Graham & Hyde, O’Shea Builders, and Meristem Advisors) have demonstrated a need for long-term sustainable funding, which is best accomplished by increasing operating funds rather than borrowing money (issuing bonds). The library can maintain materials, programming, and staffing budgeting levels by ensuring building maintenance issues are attended to as part of the operations levy. Also, passing an operations levy increase now will ensure that the library does not need to ask for an additional operations increase in the future.

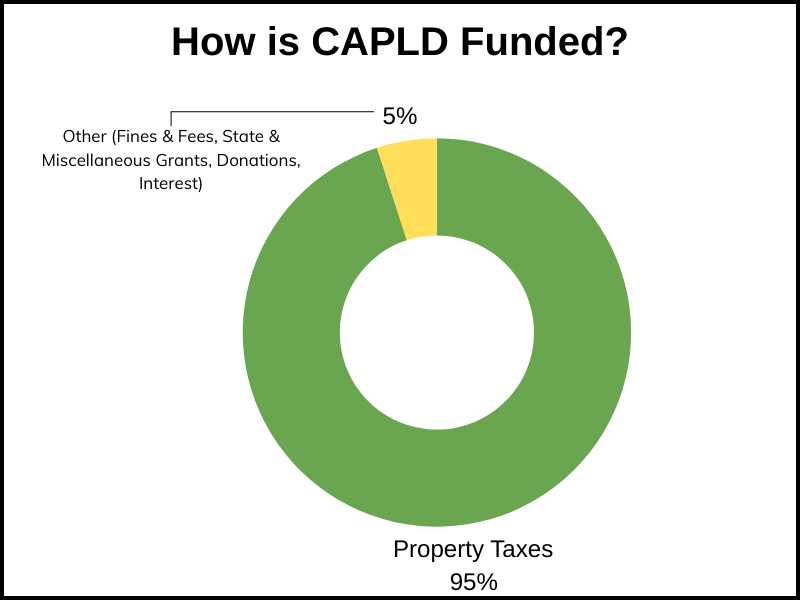

15. How is the CAPLD funded?

95% of library funds come from property taxes. The remaining 5% is received from fees, donations, and grants.

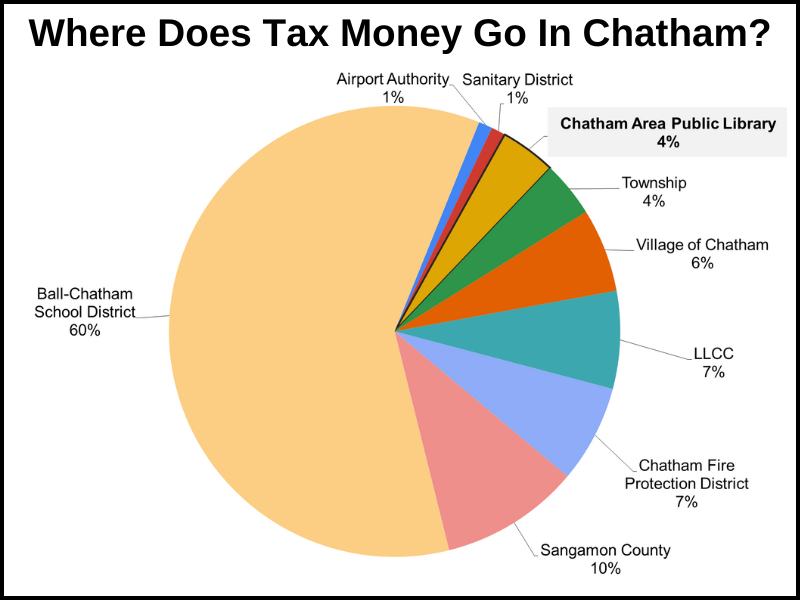

16. Where do my taxes go if I live in Chatham?

Although the Library collaborates with other local taxing bodies on mutually beneficial projects, it receives no additional funding from the Village of Chatham or other entities. The graph below details the percentage of an average tax bill that goes to library funds, as well as other taxing bodies:

17. How big is the CAPLD? (who is served by the district)

The CAPLD serves 17,357 (as of the 2020 US Census), an 11.51% increase since 2010. The district map shows our boundaries. Our east, south, and west sides are similar to the Ball-Chatham School District, while our northside boundaries are not the same. Those living within the boundaries of the Ball-Chatham School District and the boundaries of the City of Springfield support and are served by Lincoln Library.

18. What do the Friends of the Library do?

The Friends of the Library are a separate 501(c)(3) non-profit organization from the Library District. Friends volunteers run the Bahlow Bookstore and Bank & Trust Cafe, host book sales, and an annual murder mystery theater fundraiser. In 2024, the Friends contributed over $10,000 for additional programming, equipment, and services the library could not otherwise provide. The Friends board, not the Library Board of Trustees, has sole discretion on how their organization will fundraise and what they will fund. More information about the Friends can be found at https://www.chathamlib.org/friends-library

19. What does the Foundation do, and explain the Backyard project

The Library Foundation falls under the non-profit 501(c)(3) umbrella of the Friends of the Library and is, therefore, a separate entity from the Library District. The goal of the Foundation is to support long-term giving and provide significant gifts to the Library. After the building expansion in 2009, the Foundation paid for the permanent art collection and landscaping for our building.

Since the 2009 renovation, the Foundation has invested its resources for long-term financial growth. More recently, they have sought donations to enhance the South side of the library property with an outdoor space known as The Backyard Project. This space will expand the programming and seating area of the library outdoors. The Foundation has been raising money for this project and will give the money to the Library Board of Trustees solely to construct the Backyard Project. The Library Board of Trustees will complete the construction of this project. The goal for completion is the 2nd or 3rd quarter of 2025. More information about the Foundation can be found at https://www.chathamlib.org/capld-foundation.

20. Who can I call for more information, or how can I take a tour?

Please call Library Director Amy Byers at 217-483-2713 or email at [email protected].